With latest Volkswagen investment, Leitmotiff is expected to reach new, unprecedented heights. For the past 16 months, a venture capital firm called Leitmotif has been quietly making waves, investing in around 20 startups focused on decarbonization. These companies span various industries, from electric vehicles (EVs) to space tech, battery innovations, and nuclear fusion. Until now, Leitmotif had only disclosed its backing by “European industrial interests.”

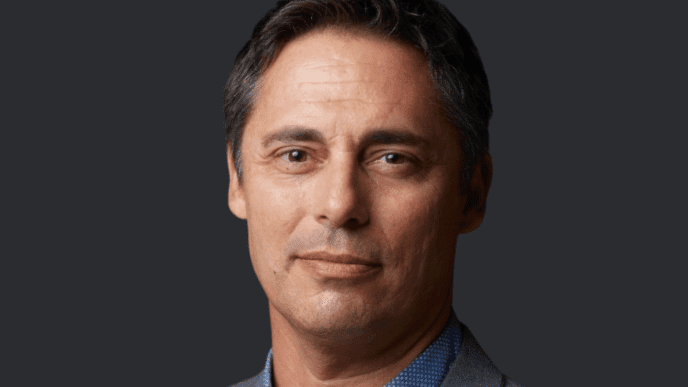

Now, the firm has confirmed its primary investor: Volkswagen Group.

Volkswagen’s Strategic $300M Investment

Volkswagen has committed a staggering $300 million to Leitmotif’s first fund, becoming its sole limited partner. So far, Leitmotif has allocated about one-third of these funds. During a recent conference, Volkswagen Group CEO Oliver Blume emphasized that these investments aim to reduce the company’s carbon footprint while fostering a circular economy both within and beyond the automaker’s operations.

“Volkswagen culture is team culture,” Blume stated.

Beyond Volkswagen’s direct involvement, Leitmotif’s managing partners, Matt Trevithick and Jens Wiese, envision future funds attracting broader European industrial interest. Their goal is to build a robust investment ecosystem that bridges Europe’s industrial powerhouses with cutting-edge U.S. innovations.

Tackling the Challenges of Deep Tech Funding

Securing capital for hardware-focused startups has been challenging in recent years, particularly those requiring large-scale manufacturing. However, Trevithick sees an opportunity in this adversity.

Leitmotif’s transatlantic investment approach aims to navigate the current geopolitical landscape, which has been affected by trade tensions and policy shifts. Despite these challenges, Wiese—who previously led Volkswagen’s M&A and investment division—stressed that the firm’s core mission is to create a bridge between European industrial leaders and the thriving U.S. startup ecosystem.

Profit First, Innovation Second

While Leitmotif is committed to supporting groundbreaking startups, Volkswagen’s primary directive for the fund remains clear: generate strong financial returns.

Although Volkswagen generates hundreds of billions in annual revenue, Wiese emphasized that making money through investments remains a key metric in the industry.

Beyond profitability, Leitmotif aims to identify and back category-defining companies while scouting emerging pockets of innovation that could benefit Volkswagen. Wiese estimated that about 25% of Leitmotif’s portfolio will directly interact with Volkswagen and its numerous brands.

One such example is Harbinger, an EV truck startup. Leitmotif co-led Harbinger’s $100 million Series B funding round in January. Wiese confirmed that Harbinger has engaged in discussions about collaborating with Volkswagen’s trucking division.

U.S.-EU Investment Strategy

Leitmotif plans to allocate about 70% of its capital to U.S.-based startups, with the remaining 30% going to European companies. The firm will maintain offices in both Palo Alto and Munich to support this strategy.

Trevithick outlined the firm’s approach, stating that 70% of investments will go toward solving current, well-defined problems in billion-dollar markets with ready-to-buy customers. The remaining 30% will target “revolutionary innovation” capable of creating billion-dollar industries in the 2030s and beyond.

Strategic Portfolio Highlights

So far, Leitmotif’s investment portfolio includes:

- Redwood Materials – A leader in battery recycling

- Stoke Space – A reusable rocket company

- Syre – A circular polyester startup

Leitmotif has publicly disclosed investments in 13 startups but has additional, undisclosed investments as well.

Future Expansion Plans

Leitmotif’s managing partners have already set their sights on future funds, particularly in robotics and artificial intelligence (AI). While Volkswagen will have the option to invest in these emerging areas, Leitmotif remains an independent firm focused on deploying its first fund successfully.

Timing: Capitalizing on Market Downturns

Late 2023 was one of the toughest times in recent memory for startups to secure large funding rounds, especially those in hardware or deep tech, due to rising interest rates. However, Trevithick believes this downturn created a prime opportunity to launch Leitmotif.

“In down markets, strong companies separate from the weak. In a bubble, everyone gets funded,” he explained.

During this period, many venture firms became more conservative, focusing on their existing portfolios rather than seeking new opportunities. This opened doors for Leitmotif to invest in promising startups that might have been out of reach during a booming market.

Leveraging Industry Expertise

Leitmotif’s leadership brings extensive experience to the table. Wiese spent nearly eight years managing Volkswagen Group’s mergers, acquisitions, and investments, developing a deep network across Europe and the U.S. His past board membership at QuantumScape—a leading battery maker—further solidifies his venture capital credentials.

Trevithick, on the other hand, was a longtime partner at Venrock, where he played a pivotal role in clean tech investments, including an early bet on Atieva, the startup that later became Lucid Motors. His experience navigating the highs and lows of the clean tech industry provides valuable insights for guiding Leitmotif’s strategy.

The Future of Clean Tech Investing

Despite some corporations hedging or even abandoning their net-zero commitments, Trevithick believes the clean tech sector is in a stronger position today than during the previous investment cycle.

He also sees today’s volatile economic and geopolitical environment as a catalyst for startups and venture capitalists to thrive.

“We can all agree it’s going to be a highly volatile environment, which should disproportionately favor entrepreneurs, startups, and venture capitalists,” he said.

Wiese echoed this sentiment, adding that while decarbonization remains Leitmotif’s overarching theme, the firm prioritizes investing in startups with strong business fundamentals—companies that can succeed regardless of industry trends or shifting government policies.

With Volkswagen’s backing and a bold vision for the future, Leitmotif is positioning itself as a major player in the clean tech and deep tech investment landscape.

Catch up with more startup news here.