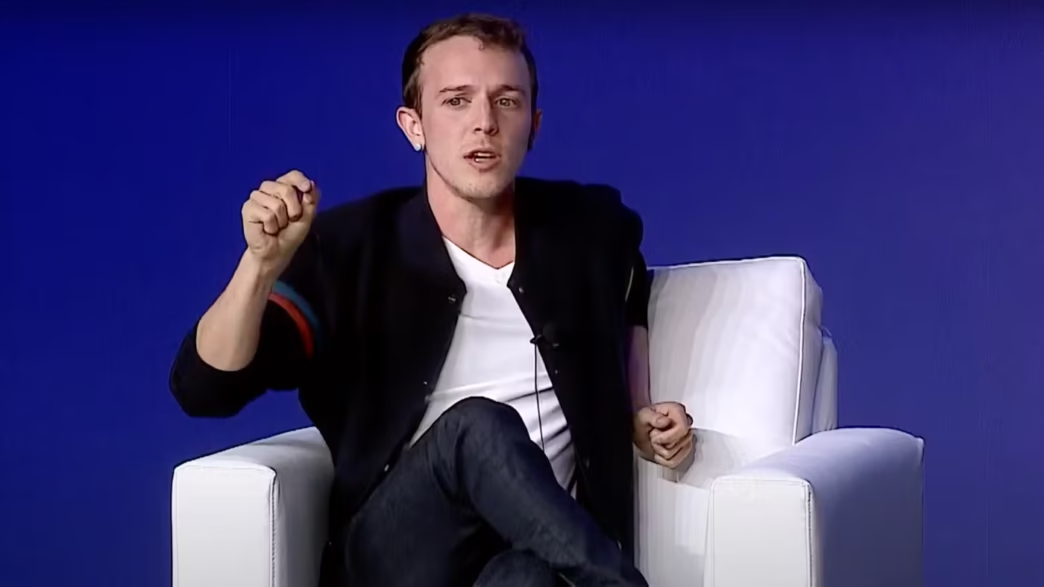

Ryan Breslow, the co-founder of Bolt who recently returned as CEO, broke his silence on Monday regarding the controversial $30 million personal loan that led to legal disputes and played a role in his temporary departure. He also unveiled plans for a groundbreaking “super app” designed to integrate seamless one-click checkouts across various financial services, including crypto and peer-to-peer transactions.

The Legal Battle Over Breslow’s Loan

The dispute surrounding the loan began in 2023 when Bolt investor Activant filed a lawsuit against Breslow. The firm alleged that he burdened the startup with $30 million in debt by taking out a personal loan and later defaulting, which forced Bolt to cover the repayment.

The case was eventually settled in 2024, with Bolt repurchasing Activant’s shares for $37 million. Speaking at the Fintech Meetup in Las Vegas, Breslow defended the loan, arguing that it was a strategic move to demonstrate his confidence in Bolt rather than an act of self-interest.

“I took out the loan instead of selling my shares because I wanted to show my unwavering commitment to the company,” Breslow explained. “The board unanimously approved it, and my intention was to repay it after an IPO.”

However, after stepping down as CEO, the board demanded repayment, a move Breslow perceived as an attempt to undermine him.

Breslow Acknowledges Past Mistakes

Breslow stepped away from the CEO role in early 2022. In the years that followed, he faced allegations of misleading investors and violating securities laws by inflating company metrics during fundraising rounds.

On Monday, he admitted to making “a ton of mistakes” but refuted claims of intentional wrongdoing. Instead, he cited his primary mistake as allowing investors into Bolt’s cap table without fully vetting them.

Bolt’s Bold Move: A One-Click ‘Super App’

Now back at the helm, Breslow is spearheading a major expansion, positioning Bolt to become a one-stop financial powerhouse. The company is set to launch a “super app” that will revolutionize online transactions.

“Instead of just one-click checkout, we’re introducing one-click everything—financial services, peer-to-peer payments, crypto, cards, and more—all within a single app,” Breslow announced.

He compared Bolt’s potential to Revolut, a U.K. fintech giant valued at $45 billion in 2024. Breslow highlighted Bolt’s 80 million digital wallets, surpassing Revolut’s 45 million, though he admitted that monetization remains a work in progress.

The Uncertainty Around Bolt’s Fundraising Efforts

One looming question for Bolt is the status of its pending $450 million fundraising deal. Last August, reports emerged about the unusual structure of the deal, which involved $250 million in marketing credits. Additionally, a lead investor was mistakenly identified, raising further concerns.

Some major investors, including BlackRock and Hedosophia, attempted to block the funding round, but lawsuits related to the matter have since been dismissed, Bolt confirmed on Monday. However, Breslow did not provide further updates on the fundraising process.

Breslow’s Renewed Drive to Lead Bolt

Reflecting on his turbulent journey, Breslow shared that the challenges he faced had fueled his determination to drive Bolt forward.

“I’ve learned a lot, and I’m more motivated than ever,” he said. “I’m ready to take Bolt to new heights.”

With the legal battles behind him and a bold vision ahead, Breslow is set on transforming Bolt into a fintech giant. The coming months will reveal whether his ambitious ‘super app’ will redefine digital commerce or face the same hurdles that have marked his tenure at the company.

Read more startup news here.