Toronto-based fintech startup Keep has raised $12 million in new equity funding, accelerating its mission to become Canada’s go-to platform for managing corporate spending. As the competition among financial platforms targeting small and medium-sized businesses (SMBs) heats up across North America, Keep is quickly carving out a niche in a growing but still underdeveloped Canadian market.

The latest round, categorized as a Series A1, was led by Tribe Capital, which also backed Keep’s earlier $8 million Series A in 2023. In total, the company has secured $23 million in equity, along with a $50 million credit facility from Treville Capital Group and $3 million in venture debt from Silicon Valley Bank.

Co-founders Oliver Takach and Helson Taveras started Keep in 2021 after growing frustrated with the limited and outdated financial tools offered by traditional banks. Takach, a two-time Y Combinator alumnus, drew from his own experience as a founder of companies like CareLedger and Origin — both now inactive — and a third startup, Retriever, which was eventually acquired.

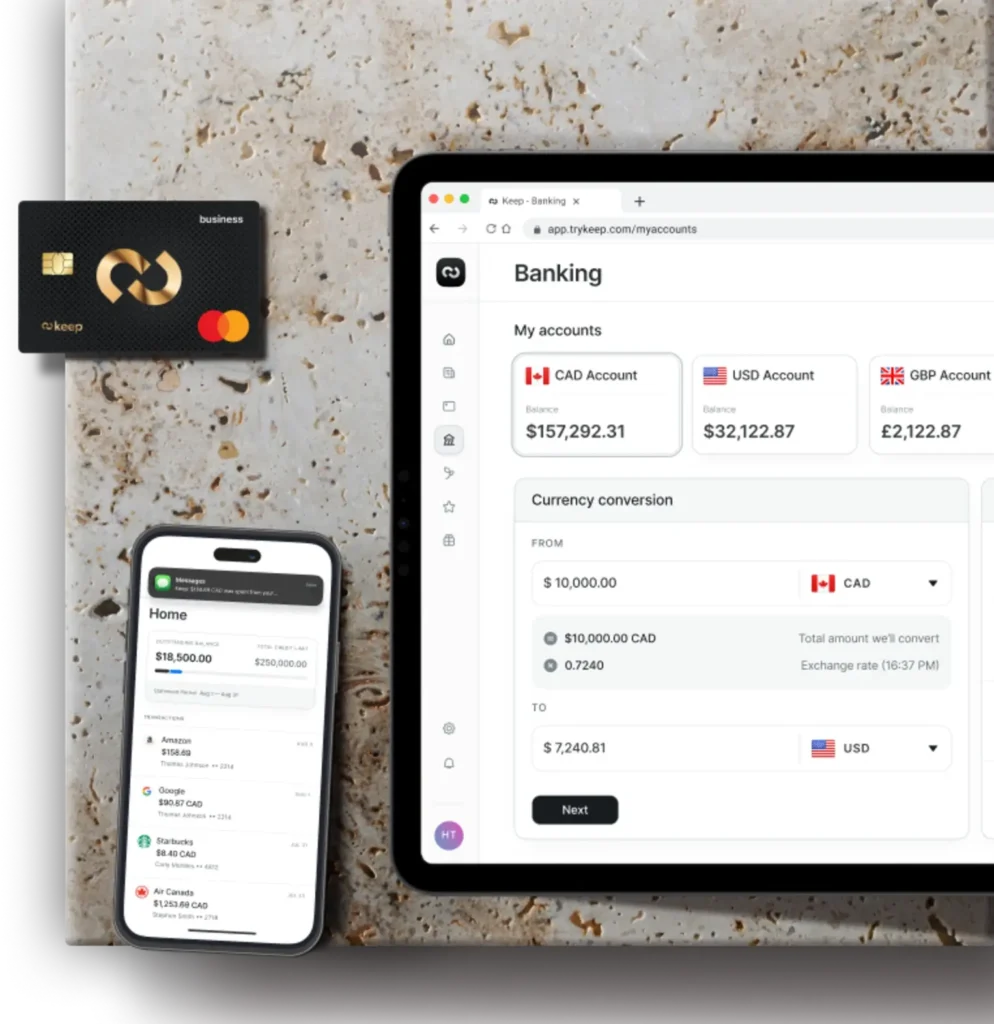

Since launching its corporate credit card in 2023, Keep has expanded its product suite to include multi-currency business accounts, automated expense management, and accounting software integrations. The platform positions itself as the “mission control” for SMB finances, simplifying operations for companies that need more than just a basic credit card.

That strategy is paying off. By early 2024, Keep had surpassed $14 million in annualized revenue and was serving over 3,000 SMBs, many of which operate internationally. The startup’s revenue comes from multiple streams: interchange fees from card use, capital advance fees, installment loan interest, and premium options like instant fund transfers and currency exchange.

According to CEO Takach, Keep’s valuation has increased fivefold since its Series A round, with a 20x jump in revenue over the same period. He sees the startup’s multi-currency capabilities as a core differentiator — a feature that gives Canadian SMBs the ability to “bank like a local” across borders and handle cross-currency operations with ease.

Keep’s closest competitor is another Toronto fintech, Float Financial, but Takach believes Keep’s all-in-one infrastructure and embedded finance roadmap give it a critical edge. That includes planned product additions like bill pay, embedded credit, and a banking product still under wraps.

Backing the company alongside Tribe Capital are notable investors including Rebel Fund, Liquid 2 Ventures, Cambrian, Assurant Ventures, and a slate of high-profile angels: Dropbox’s Arash Ferdowsi, Webflow’s Vlad Magdalin, Alloy’s Tommy Nicholas and Laura Spiekerman, and Marc Bhargava of General Catalyst.

As Tribe Capital’s Arjun Sethi put it, the bar for modern business banking has permanently shifted. Features like real-time currency conversion, flexible employee spend controls, and seamless cross-border transactions are no longer nice-to-haves. They’re the baseline.

And Keep is betting that Canadian businesses — and their increasingly global ambitions — will demand nothing less.