Veza, a fast-rising security startup focused on access management visibility, has secured $108 million in fresh funding, attracting backing from cloud software heavyweights Atlassian, Snowflake, and Workday. The financing round, led by New Enterprise Associates, now values Veza at just over $800 million, including the new capital injection.

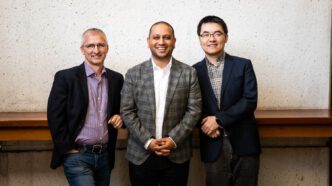

Founded in 2020 by Tarun Thakur, Rob Whitcher, and Maohua Lu, Veza helps companies monitor and control what internal technologies employees can access. At a time when tech giants like Google, Amazon, Microsoft, and Nvidia dominate headlines with massive bets on AI startups, Veza’s rise shows cloud vendors are equally eager to invest in cybersecurity innovation.

Snowflake has been using Veza’s platform for two years to manage and audit employee access rights across its internal tools. Harsha Kapre, director of Snowflake’s venture group, emphasized that over-provisioning employee access significantly increases security risks. With Veza, managers can quickly review and adjust access permissions for both employees and automated accounts, ensuring tighter security policies.

Veza’s platform has integrations with more than 250 technologies, including Snowflake itself. By simplifying the process of managing access across complex corporate environments, the startup tackles a long-overlooked but growing problem as identity and permissions sprawl across organizations.

This funding round arrives during a tough period for traditional venture firms. Startup exits have slowed considerably following the spike in inflation and higher interest rates starting in 2021. According to PitchBook, venture deal volume dropped sharply from over 11,000 in the first quarter of 2024 to 7,551 deals in the first quarter of 2025. Unlike traditional VCs, corporate venture arms like those from Atlassian and Snowflake operate differently, focusing heavily on strategic benefits rather than just financial returns.

For instance, Atlassian typically asks portfolio companies to report customer integration rates, while Snowflake evaluates whether its investments drive increased product usage. Kapre noted that Snowflake’s investment pace has accelerated as the company sees tangible benefits from supporting key technology partners.

Veza’s focus on identity visibility places it in a promising sector. Cyberattacks continue to surge globally, lifting demand for next-generation security platforms. The First Trust Nasdaq Cybersecurity ETF, which tracks companies like CrowdStrike and Palo Alto Networks, has posted modest gains this year despite broader tech market declines.

Unlike traditional identity management giants such as Microsoft and Okta, Veza carves out a unique niche by offering deep visibility into access permissions — an area often neglected until recently. Gartner analyst Brian Guthrie highlighted how enterprises have only recently realized the critical need for detailed auditing around identities and permissions, especially as the number of user accounts and AI agents skyrockets.

Thakur, who runs Veza from his Los Gatos, California home, said that corporate security teams are waking up to the strategic role of access visibility. “We have woken up a sleeping industry,” he said, emphasizing that modern security cannot ignore who has access to what inside corporate systems. Veza’s customer roster already includes big names like AMD, CrowdStrike, and Intuit, with sales reportedly more than doubling in its most recent fiscal year.

Looking ahead, Veza plans to use the new funds to deepen its presence in the U.S. government market, expand internationally, and add support for managing AI agents’ identities — a growing challenge as companies deploy more automated systems alongside human workers.

Atlassian’s head of ventures, Peter Lenke, said the firm sees great synergy in backing startups like Veza. Although Atlassian is not yet a customer, Lenke noted that their large enterprise footprint can offer future opportunities for portfolio companies. “There’s a great symbiotic match here,” he added.